Carnage On D-Street: Sensex Posts Worst Week In Eight Months — What’s Next For Indian Investors?

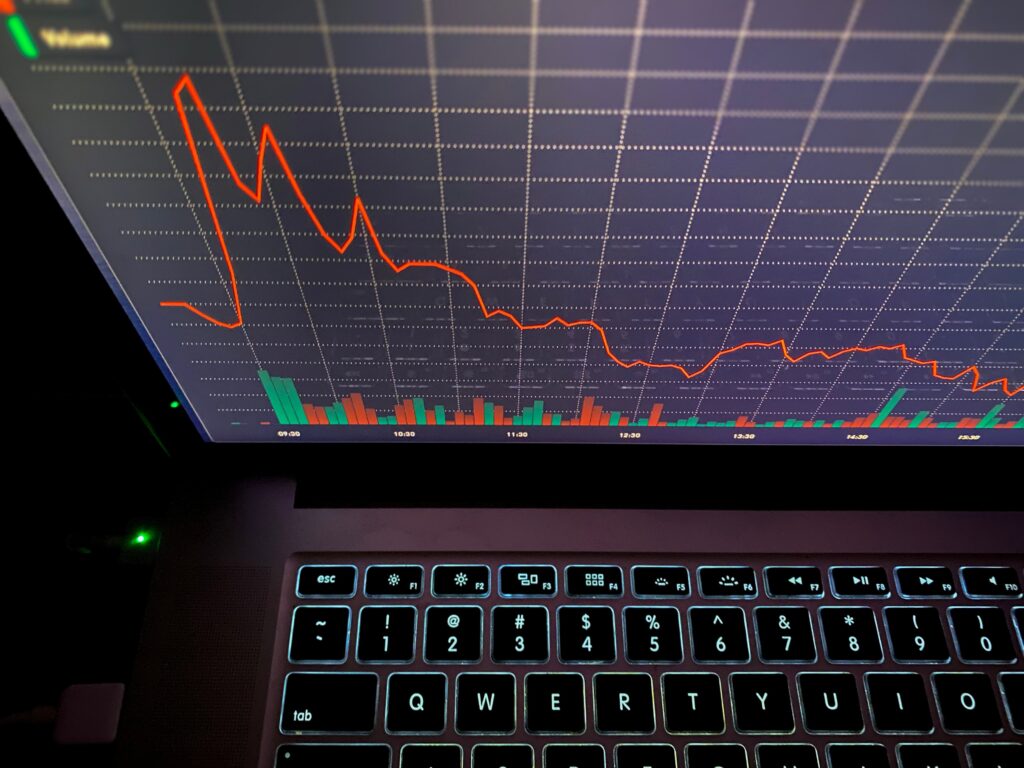

The Indian stock market suffered its sharpest weekly fall in nearly eight months, with both the Sensex and Nifty ending deep in the red. The Sensex shed 2.66% this week, weighed down by heavy losses in IT, auto, and pharma counters. The Nifty fell 3% over the past six sessions, slipping below the key 25,000 mark, while the broader markets underperformed with Nifty Midcap100 and Smallcap100 each down more than 2%.

Stocks That Defied The Market Rout

Despite the rout, a handful of stocks managed to buck the trend. Maruti Suzuki India Ltd. emerged as the best performer on the Sensex, rising 2.49%. Axis Bank Ltd. followed with a gain of 1.57%, while Larsen & Toubro Ltd. added 1.50%.

Worst Performers On The Index

In contrast, the selloff was brutal across heavyweight counters. Tech Mahindra Ltd. plunged 9.43%, Tata Consultancy Services Ltd. dropped 8.51%, and Trent Ltd. lost 7.84%, making them the worst performers on the index. Infosys Ltd. and HCL Technologies Ltd. also fell sharply, declining 5.95% and 4.92%, respectively.

Pharma Stocks Witness Significant Declines

Pharma stocks witnessed significant declines after the United States announced a 100% tariff on imports of branded drugs starting Oct. 1, unless the manufacturer operates a production facility in the US. This move is expected to have a significant impact on the Indian pharma industry, with many companies having a significant presence in the US market.

Sectoral Analysis

Sectorally, nearly all indices saw profit-booking at higher levels, with IT and Realty taking the heaviest blows, as per analysts. The IT index slipped 7.73% for the week, while Realty shed nearly 6%. Brokerages remain cautious on Indian IT. Jefferies flagged a steady-to-moderating growth outlook, while Goldman Sachs warned FY27 estimates could be at risk without a pickup in discretionary demand. Citi added that FY26 may be the third straight year of weak growth amid AI disruption, GCC expansion, and rising competition.

Technical Analysis

On the technical side, the market slipped below its 20- and 50-day simple moving averages as Sensex breached the crucial 81,800 support zone, a development analysts flagged as negative.

Market Outlook

‘We expect markets to remain under pressure in the near term, tracking global headwinds, key macroeconomic data, and potential development around the India–US trade talks,’ said Siddhartha Khemka of Motilal Oswal Financial Services.

What’s Next For Indian Investors?

Given the current market scenario, it’s essential for Indian investors to remain cautious and keep a close eye on the global and domestic developments. The Indian stock market is expected to remain volatile in the near term, and investors should be prepared for any eventuality. It’s also crucial to have a well-diversified portfolio and to avoid making any impulsive decisions based on short-term market fluctuations.

Conclusion

In conclusion, the Indian stock market witnessed a sharp decline last week, with the Sensex and Nifty ending deep in the red. While some stocks managed to defy the market rout, others witnessed significant declines. As we move forward, it’s essential to keep a close eye on the global and domestic developments and to remain cautious in our investment decisions. With the right strategy and a well-diversified portfolio, Indian investors can navigate the current market scenario and achieve their long-term financial goals.